Cryptocurrency has emerged as a revolutionary digital asset, challenging traditional financial systems and introducing a new paradigm of currency and asset ownership. With its rise, the platforms that facilitate the trading and management of these digital assets known as cryptocurrency exchanges—have become gateways for both seasoned investors and newcomers to participate in cryptocurrency trading.

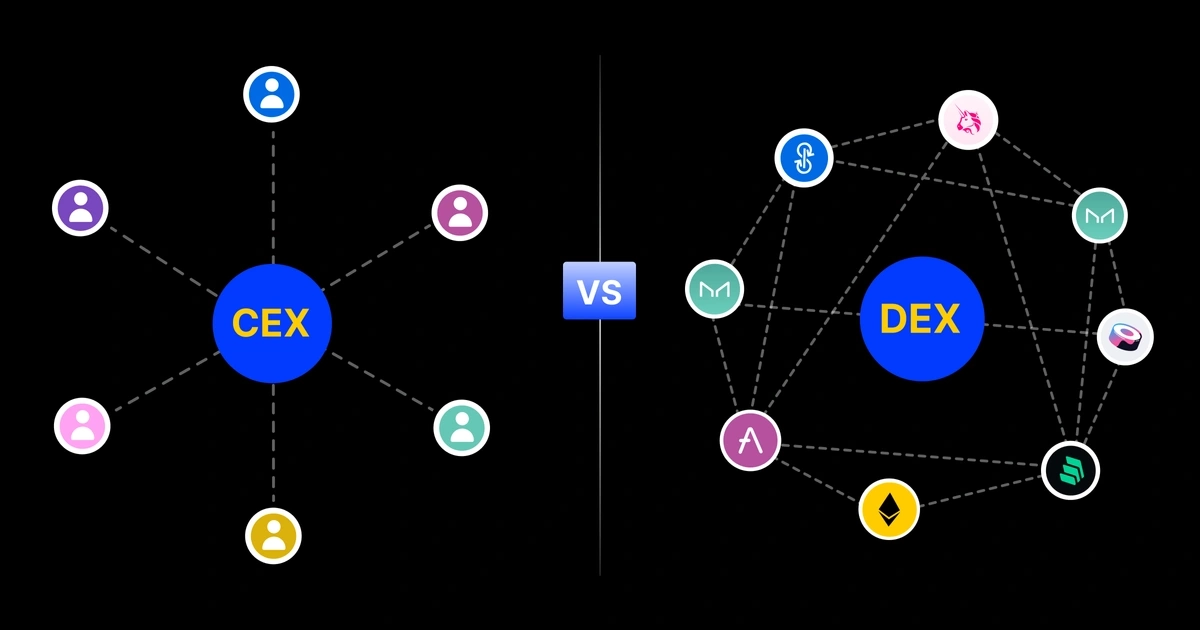

However, knowing where to start can be a bit confusing. Particularly with all the new terminology. Essentially, cryptocurrency exchanges are broadly categorized into two types: Centralized Exchanges (CEX) and Decentralized Exchanges (DEX). Understanding the differences between these platforms is essential, yet it can be confusing for beginners. In this blog we take a look at CEX vs DEX, comparing their features, functionality, who they’re suited to, and much more.

What Are They? Centralized Exchange vs Decentralized Exchange

What is a CEX?

Centralized Exchanges (CEX) are platforms where the top cryptocurrencies can be traded. They act as intermediaries between buyers and sellers, and typically, a single organization runs these platforms. This central authority manages the exchange, facilitating trades, securing transactions, and often providing wallet services. Users of centralized exchanges do not have direct control over their private keys, which means they do not have complete control over their cryptocurrencies. Instead, they trust the exchange to manage their funds securely.

What is A Decentralized Exchange (DEX)?

Decentralized Exchanges (DEX) are platforms that allow users to trade cryptocurrencies directly with one another without the need for an intermediary or central authority. These exchanges run on blockchain technology and utilize smart contracts to facilitate and execute trades securely and autonomously. Unlike centralized exchanges, DEXs enable trading in a trustless environment, where users maintain control of their private keys and thus their crypto assets throughout the transaction process.

Overview of Popular CEX Exchanges and Their Features

1. Binance: Known for its low trading fees, Binance offers a wide range of cryptocurrencies and trading pairs. It also features advanced trading options like futures and options, and a native token (BNB) that offers trading fee discounts.

2. Coinbase: Renowned for its ease of use, making it ideal for beginners. Coinbase offers educational content to earn crypto and a secure wallet app. However, it generally has higher fees compared to other exchanges.

3. Kraken: Praised for its security measures and extensive range of supported cryptocurrencies. Kraken also offers futures trading and margin trading.

4. Bitfinex: Known for catering to more professional traders with advanced trading features, including several types of order types and high liquidity.

Examples of Successful Trading Strategies on CEX Platforms

Day Trading

Involves buying and selling cryptocurrencies within the same trading day. Traders capitalize on short-term price movements and use tools like technical analysis to make decisions.

Scalping

A scalping strategy involves making dozens or even hundreds of trades per day to "scalp" a small profit from each trade. Scalpers benefit from high liquidity and lower trading fees on CEXs.

Swing Trading

Traders hold cryptocurrencies for several days or weeks to benefit from anticipated upward or downward market shifts. This strategy requires understanding market trends and may involve both technical and fundamental analysis.

Arbitrage

Arbitrage involves buying a cryptocurrency on one exchange where the price is low and immediately selling it on another exchange where the price is higher. This strategy exploits price discrepancies between exchanges and is quite common in the fragmented crypto market.

Using these strategies on centralized exchanges can be beneficial due to the advanced trading tools available, but it’s essential to be aware of the risks involved, including market volatility and potential security threats.

Popular DEX Exchanges and Their Features

1. Uniswap: Based on the Ethereum blockchain, Uniswap is known for its simple interface and automated liquidity provision via liquidity pools rather than traditional order books.

2. SushiSwap: A fork of Uniswap with added features like on-chain governance, staking rewards, and a development fund aimed at better incentivizing community involvement.

3. PancakeSwap: Runs on Binance Smart Chain, offering lower transaction fees compared to Ethereum-based DEXs. It also includes features like lottery, staking, and yield farming.

4. Curve Finance: Specializes in stablecoin trading and aims to provide low slippage and high liquidity for these trades, utilizing a unique automated market maker (AMM) design optimized for stablecoins.

Examples of Successful Trading Strategies on DEX Platforms

Liquidity Providing

Users can contribute to liquidity pools on a DEX and earn trading fees as liquidity providers. This involves staking crypto assets in a pool to facilitate trading by others.

Yield Farming

Users can move assets across different liquidity pools to maximize yield or returns from trading fees and other incentives like newly minted tokens.

Arbitrage

Similar to CEXs, traders can exploit price discrepancies between different DEXs or between a DEX and a CEX to make profits.

Token Swapping for Quick Gains

Traders can swap tokens quickly in response to market news or events that are expected to impact prices, utilizing the immediate execution nature of smart contracts.

Future Development Prospects: CEX vs DEX Crypto

Centralized Exchanges (CEX)

Future developments in centralized exchanges are likely to focus on regulatory compliance and security enhancements. As regulatory frameworks around cryptocurrencies become clearer, CEXs could attract more institutional investors and traditional financial entities, increasing liquidity and stability. Alongside this, CEXs are expected to continuously improve their security measures to build trust and safeguard user assets. Moreover, there may be an expansion in services offered, including integration with traditional financial products like tokenized stocks and ETFs. Global expansion into new markets with services tailored to local needs and regulatory requirements is also anticipated.

Decentralized Exchanges (DEX)

Decentralized exchanges will likely benefit from technological advancements that improve transaction speeds and efficiencies. These include scaling solutions and cross-chain protocols that make DEXs more competitive with their centralized counterparts. There's also potential for DEXs to expand their range of financial products to include more complex instruments like derivatives and futures. Enhancements in liquidity solutions could address current limitations in liquidity, making DEXs more attractive to a wider range of traders. While DEXs operate in a less regulated space, increasing regulatory attention might prompt changes that could integrate more transparency or user identification processes, impacting the core privacy aspect of DEXs but potentially leading to broader acceptance.

In Summary

Overall, the key difference between centralized and decentralized crypto exchange lies in the management of user assets and the operational structure. Centralized exchanges (CEX) hold and manage users’ funds, offering a user-friendly platform with high liquidity and a broad range of trading tools, but requiring trust in the exchange's security measures. Decentralized exchanges (DEX), on the other hand, allow users to retain control of their private keys and execute trades directly on the blockchain, offering greater privacy and security at the cost of user experience and liquidity.

Ultimately, deciding which is best for you comes down to your trading and security goals. If you’re all-in on decentralization and believe in the trustless nature of the blockchain, then DEXs are for you. If morality isn’t a driving force and you simply care more about turning a profit with user-friendly platforms, then CEXs are the way to go.