Cryptocurrency is evolving rapidly, but trust remains a vital commodity. As a small business owner, stepping into decentralized finance can seem an impossibility. However, understanding the role of crypto escrow services in securing your transactions can be a game-changer for your operations.

Imagine this: you're about to make a significant purchase for your business, but there's a catch — both you and the supplier are wary about the trustworthiness of one another. This is how an escrow service comes in, acting as a trusted intermediary holding the payment until both parties fulfill their end of the deal. In the realm of cryptocurrency, where transactions are irreversible, the security that escrow services provide is not just comforting; it's essential.

Key Takeaways About Crypto Escrow Services

- Escrow services safeguard crypto transactions, providing security where reversals aren't possible.

- They ensure fair trade, releasing funds only when both parties fulfill their agreement.

- Boosting business confidence in crypto, escrow services encourage wider cryptocurrency adoption.

- Selecting a reputable escrow service is critical for transaction integrity and dispute resolution.

What Are Crypto Escrow Services?

Crypto escrow services are third-party intermediaries that hold and regulate the payment of the funds required for two parties involved in a given transaction, ensuring it only completes when all of the agreed-upon conditions are met. Think of them as a digital middleman who holds onto the money until both the buyer and the seller are happy with a deal.

These services provide a layer of security for local and international cryptocurrency transactions, where payments are permanent once sent. They help protect against fraud by making sure that the buyer gets what they paid for and the seller gets their money after delivering the goods or services. This is particularly important in the crypto space because it lacks a central authority like a bank to oversee and reverse transactions if something goes wrong.

Examples of Crypto Escrow Services

ZERT: A Pioneering Crypto Escrow Service

ZERT serves as an exemplary model of a crypto escrow wallet and service, meticulously designed to cater to the needs of both consumers and businesses within the digital marketplace. By acting as a neutral intermediary, ZERT safeguards transactions until all parties fulfill their agreed-upon obligations, thereby instilling trust and ensuring a fair exchange process.

CLICK HERE TO LEARN ABOUT ZERT ESCROW CAPABILITIES

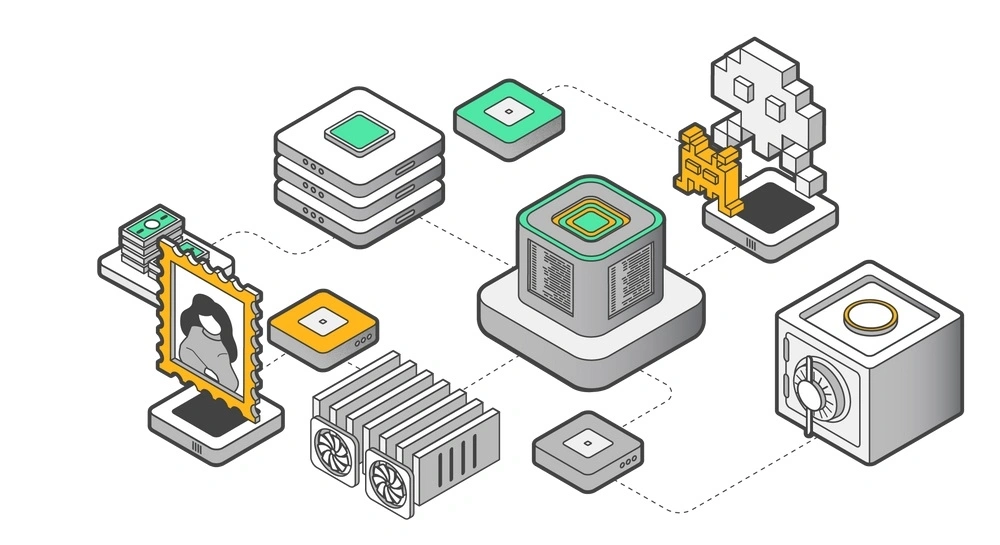

Security and Compliance: ZERT prioritizes transaction security and legal compliance with products such as a digital safe deposit box. The service is fully licensed across multiple jurisdictions, including the US, EU, Canada, and UAE. This licensing underpins its commitment to adhering to stringent regulations and protecting client interests.

Verification and Trust: Extensive user verification systems, such as KYC (Know Your Customer), KYB (Know Your Business), and AML (Anti-Money Laundering), are in place to ensure that all transactions are fully vetted. Such measures are critical in preventing fraud and ensuring that only legitimate transactions flow through the platform.

Advanced Technology: ZERT utilizes advanced technologies, including MPC (Multi-Party Computation) wallet technology and institutional-grade vaults that require both a public and a private key to access. This technology strikes a balance between user privacy and the need for transparency in transaction evaluation.

Efficiency and Speed: Recognizing the importance of transactional fluidity, ZERT ensures that transactions are processed promptly, allowing for swift disbursement of funds upon authentication. This efficiency is crucial for enhancing crypto cash flow for businesses and individuals alike.

Customization and Flexibility: ZERT understands that one size does not fit all in the crypto world. The platform offers the flexibility to tailor settings and protocols to meet specific needs, uniting the benefits of hot and cold wallets. Users can create a personalized escrow account that aligns with their operational goals without compromising on security or speed.

Powered by Fireblocks: At the heart of ZERT's system is the renowned Fireblocks technology. This ensures that even the most complex transactions are executed seamlessly and securely, catering to a wide array of users, from traders to banks. Fireblocks provides the assurance of fast and secure transactions, a cornerstone of ZERT's service offering.

BTC Asia

BTC Asia presents a streamlined Bitcoin escrow service tailored for users who seek simplicity and quick transactions without the hassle of registration. It's designed for those who want to engage in Bitcoin transactions with minimal barriers to entry and who are comfortable navigating their trades without intermediary involvement.

Pros:

- Ease of Use: The escrow service is straightforward, requiring only a Bitcoin address and an email, which makes it accessible for quick transactions.

- Fee Structure: They offer an affordable fee for their services, which can be attractive for users looking to minimize costs.

Cons:

- No Dispute Resolution: They do not offer mediation services if a dispute arises, which can be a significant risk for both buyers and sellers if disagreements occur.

- Limited Currency: The escrow service is exclusive to Bitcoin, so users with other types of cryptocurrencies cannot use it.

- Trust Factor: The lack of registration might raise trust issues for some users who prefer the security of a formal account and verification process.

IBC Group

IBC Group is a versatile Bitcoin and crypto escrow service that doubles as a fundraising platform, offering its services under a licensed, regulated framework. This service is suitable for users who prioritize security and formal processes, including thorough identity checks, to ensure the legitimacy of transactions.

Pros:

- Licensed Service: Being a licensed escrow service, it adheres to regulatory standards, potentially providing a higher level of trust and security.

- Buyer Protection: The escrow service only releases funds after the buyer has confirmed satisfaction, which protects the buyer from fraud.

Cons:

- KYC Requirements: The stringent Know Your Customer (KYC) process can be a barrier for those who wish to remain anonymous or who find the process invasive.

- Bitcoin Only: Similar to BTC Asia, this escrow service restricts transactions to Bitcoin, limiting the options for users with other cryptocurrencies.

- User Experience: The process might be more complex due to the KYC requirements, which could deter some users from using the service.

WhalesHeaven

WhalesHeaven offers a modern take on crypto escrow services by employing multisig and noncustodial mechanisms to enhance security and privacy for its users. It's an innovative solution for those who are looking for a balance between robust security measures and the flexibility of conducting anonymous transactions with competitive fees.

Pros:

- Enhanced Security: The multisig and noncustodial nature of the service means that the risk of hacking is lower since funds are not held by the service itself.

- Privacy Options: With optional KYC, users have the choice to conduct transactions anonymously, appealing to those who value privacy.

- User-Friendly: The escrow platform is designed to be easily navigable for users of all levels of experience.

Cons:

- Complexity for Some Users: The multisig function, while increasing security, can be complex to understand and use for those new to such mechanisms.

- Market Presence: As a newer entrant, it may not have the same market presence as more established services, which could affect the availability of counterparties for transactions.

- Risk of New Platforms: Users might be cautious about the reliability and longevity of newer platforms compared to more established services.

What to Consider When Vetting Crypto Escrow Services

Licensing

Verify that the crypto escrow service is compliant with the regulatory frameworks of the jurisdictions it operates within. Licensing is a testament to a provider's commitment to adhering to legal standards and consumer protection laws. Check their affiliations with regulatory bodies and certifications that are relevant to financial services.

Technology

Inquire about the security features and technological framework of the escrow service. Advanced encryption methods, the use of cold storage for funds, and real-time transaction monitoring are signs of a robust technological backbone. Multisig wallets add a layer of security by requiring multiple keys to authorize a transaction, thereby preventing unilateral access or fund misappropriation.

User Verification Systems

A service that mandates strong KYC and AML procedures demonstrates a proactive stance against fraud and money laundering. This includes personal identity verification, background checks, and monitoring of transaction patterns. However, it's also important to assess the privacy measures in place to protect sensitive user data collected during these processes.

The Human Element

Automation streamlines transactions but cannot wholly replace the nuanced decision-making of experienced professionals. Ascertain the presence of a dedicated support team and their availability. The ability to reach a human for dispute resolution or transaction inquiries can be invaluable. A balanced escrow service will leverage both cutting-edge tech and expert human oversight to ensure secure and fair transactions.

Transparency

Opt for services that provide clear terms of service, fee structures, and transaction processes. The ability to track the escrow process and receive timely updates contributes to a transparent relationship between you, the escrow provider, and the other party involved in the transaction.

Flexibility and Adaptability

The crypto market is dynamic, with new tokens and assets emerging regularly. A versatile escrow service should be able to accommodate a variety of assets and adapt to changing market conditions.

Contract Enforceability

Understand how the service enforces escrow agreements. The use of smart contracts can automate enforceability based on predetermined rules within the blockchain, reducing the potential for bias or error.

Escrow Agreement Parameters

Examine how customizable the escrow agreement is. The ability to set specific conditions for release of funds, such as time-based triggers or verification of product delivery, can offer tailored protection for your unique business needs.

Emergency Protocols

In the event of a system failure or cyber-attack, it is crucial to know the service’s contingency plans. Look for services that have strong backup systems and a clear protocol for protecting and recovering funds.

Summarizing Crypto Escrow Services

The advent of escrow services in cryptocurrency is transforming the way businesses engage with digital assets. By providing a secure holding ground for funds during transactions, escrow services mitigate the inherent risks of irreversible transactions, bridging the trust gap in the decentralized finance landscape. This security net will be the catalyst for wider adoption, giving businesses the confidence to transact with peace of mind, even with partners across the globe.

The significance of escrow services extends beyond security. They enable the steady integration of cryptocurrencies into mainstream business operations. As the digital marketplace grows, the role of escrow becomes pivotal. With these services in place, the full potential of cryptocurrency's global reach and efficiency can be realized, heralding a new era of business without borders.

To kickstart your journey, be sure to choose a trusted crypto escrow partner like Zert.