Bitcoin is the most well-known cryptocurrency. Even people who don’t know what crypto is have heard of Bitcoin. It’s incredibly popular and is usually the go-to for new crypto investors.

Everything You Need to Know About Bitcoin Storage

Bitcoin is the most well-known cryptocurrency. Even people who don’t know what crypto is have heard of Bitcoin. It’s incredibly popular and is usually the go-to for new crypto investors.

However, what many people don’t consider is where to store Bitcoin. Usually, people make the rookie mistake of keeping it on the exchange they bought it on. While this is convenient and user-friendly, it comes with complications and cons – which we’ll get into.

In this article, you’ll learn about different Bitcoin wallets, the importance of self-custody, and why you should avoid storing your investment in your exchange account.

What Is a Bitcoin Wallet?

A Bitcoin wallet is a digital storage facility, either a program or hardware, that stores the private keys, so you can access and safely store your Bitcoin.

Contrary to what many people believe, a Bitcoin wallet doesn’t have your Bitcoin inside.

Rather, it is used as an access point to get to your Bitcoin. The Bitcoin itself is stored on the blockchain, the wallet acts as a gateway to stop other people from accessing it.

Where to Store Bitcoin: Self-Custody Wallet vs. Custodial

Custodial Wallets for Bitcoin and Crypto

Here's where we talk about the complications and cons of storing Bitcoin on an exchange.

The account you open on an exchange is a custodial cryptocurrency wallet. This means that the private keys to the wallet are controlled by and accessible to a third party. At no point are you given the private keys. Therefore, you don’t technically own the Bitcoin, the exchange does.

This is a bit like how a bank holds onto your money. It's super handy for people just getting into crypto because it makes buying, selling, and trading pretty straightforward. But, this ease of use doesn't come without its downsides.

Beware. There is a popular saying in the industry – not your keys, not your crypto.

Self-Custody Wallets for Bitcoin and Crypto

Self-custody means you open a wallet and transfer your Bitcoin to it. There is no third party that has your private keys or access to your funds – only you. Unlike custodial wallets where a third party holds your Bitcoin and other crypto, self-custody wallets mean you're the one in charge. You manage the private keys, which are critical for accessing and transacting your Bitcoin. Another option is an air-gapped wallet.

Opting for self-custody does come with the responsibility of safeguarding your private keys and recovery phrases. Losing these can mean losing access to your Bitcoin. However, for many, the benefits of security, control, and independence far outweigh these challenges.

Here’s an in-depth look at custodial vs. self custody wallets.

Pros and Cons of Self-Custody Wallets for Bitcoin & Other Crypto

Pros

Complete Control

Self-custody puts you in full charge of your Bitcoin, eliminating reliance on third parties for access or management of your assets.

Enhanced Security

Storing private keys offline or in hardware wallets minimizes the risk of hacking, keeping your Bitcoin secure based on your own precautions.

Privacy and Autonomy

Self-custody enhances privacy by keeping transactions and holdings away from centralized oversight, embodying the decentralized nature of cryptocurrency.

Censorship Resistance

Your assets remain accessible and free from government or institutional control, crucial in environments with financial restrictions or instability.

Interoperability

Enables direct interaction with a broad spectrum of blockchain applications and DeFi platforms without intermediaries, offering flexibility in how you use your Bitcoin.

Long-Term Security

Ideal for those viewing Bitcoin as a long-term investment, providing a safe haven from exchange-related risks and market volatility.

Inheritance Planning

Simplifies including Bitcoin in estate plans, ensuring heirs can access your assets with the necessary information, like seed phrases and private keys.

Cons

Responsibility for Keeping Track of Access

The security advantage of self-custody comes with the responsibility to safeguard your private keys and recovery phrases. Losing them means potentially losing access to your Bitcoin permanently.

Learning Curve

Historically, self-custody requires a solid understanding of both cryptocurrency principles and secure storage practices, which might be challenging for those new to the space. However, tools like ZERT offer the benefits of self-custody but with a user-friendly dashboard.

Risk of User Error

Being in total control means any errors in handling transactions or wallet management fall solely on you, without fallback options for recovery through customer support.

Backup and Recovery Concerns

It's critical to back up and securely store your recovery phrase. Failure to do so exposes your assets to risk from physical damage or loss.

Technical Challenges

Setting up and maintaining a self-custody wallet involves technical steps that can be daunting for individuals not comfortable with technology, potentially leading to security vulnerabilities.

How to Self-Custody Bitcoin

Step 1: Buy Your Bitcoin

Before you can safely store your Bitcoin, you need to buy it. The most user-friendly option is to head to a popular centralized exchange..

They provide an easy onramp for buying Bitcoin with fiat currency. All you have to do is set up an account with your email address or phone number.

From there, add your card details, or make a bank transfer to fund your account with fiat currency.

Sometimes, there are transaction fees charged for using credit or debit cards. However, it’s free to fund your account via a bank transfer.

Once you’ve done that, you’re ready to buy your Bitcoin. Navigate to the buy section of your chosen app, hit Bitcoin, and select how much of your account balance you’d like to swap for Bitcoin.

Step 2: Create a Self-Custody Wallet For Your Bitcoin

Congratulations, you’ve finally got your first satoshis! (the smallest denomination of Bitcoin – like cents, but for Bitcoin).

It’s time to move them away from the uncertainty of the exchange to a self-custody wallet.

Creating a self-custody wallet is easy. All you need is an email address or your phone number, no other personal details.

Upon creation, you’ll be provided with a few pieces of important information:

Public key: this is the address for Bitcoin wallets – you’ll need it for transferring and receiving transactions.

Private key: this is an alphanumeric string of code used for verifying transactions.

Seed phrase: also known as a recovery phrase, this is a randomly generated collection of 12 - 24 words.

Step 3: Secure Your Private Keys & Seed Phrase

Before you do anything else, make sure to note down your private key and seed phrase and keep them safe.

You don’t have this worry when using custodial Bitcoin wallets, but if you lose your private key and seed phrase, you’ll never be able to access your Bitcoin again.

Step 4: Transfer the Bitcoin to the Self-Custody Wallet

It’s time to make the switch. In your self-custody Bitcoin wallet, hit the receive button. This will open a screen detailing your public key. Go ahead and copy this.

Now, open your crypto exchange app and find the sell section. Now, follow the process of transferring your Bitcoin to the self-custody wallet address you just created and copied.

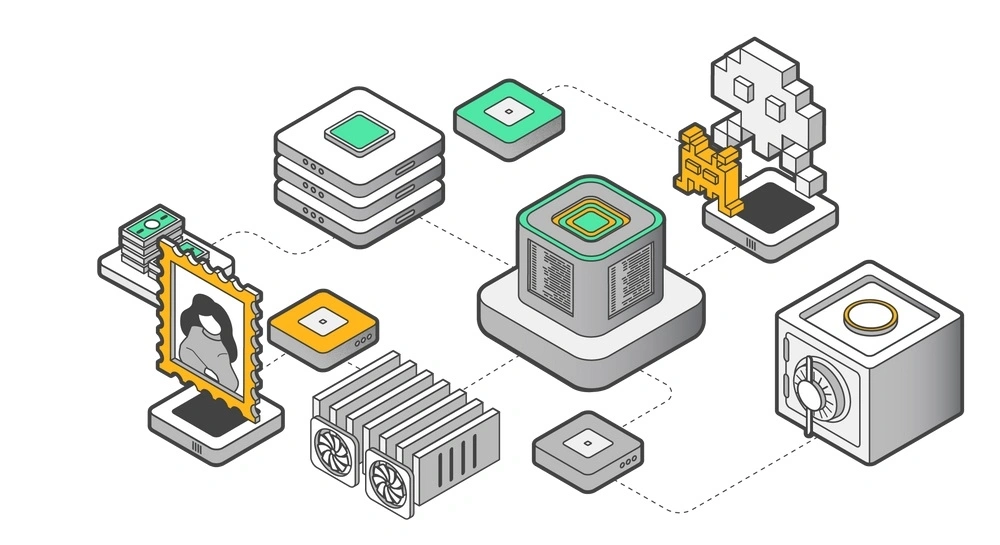

Bitcoin Wallets: Hot & Cold Storage Explained

Hot Storage & Online Bitcoin Wallet

Hot Bitcoin wallets are the most commonly used by new investors switching to self-custody. Hot wallets usually come in the form of mobile apps or browser-based extensions.

Benefits of hot Bitcoin wallets:

- Easy to set up

- Rapid transactions – open the app, and you’re ready to go

- No physical device you could potentially lose

Cons of hot Bitcoin wallets:

- Always connected to the internet and blockchain

- The easiest target for hackers and bad actors.

Cold Crypto Wallets

Cold storage or Bitcoin hardware wallets refers to keeping your Bitcoin offline. This can be done as a paper wallet or on a physical device such as a USB or hard drive.

Benefits of Bitcoin cold storage:

- More secure than hot wallets

- Reduced risk of hacks because they’re rarely connected to a network

- Private keys remain offline

Cons of cold Bitcoin wallets:

- Have to connect to an internet-enabled device to perform transactions

- They can be less user-friendly than hot wallets

ZERT's Support for Hot and Cold Wallets

ZERT seamlessly supports both hot and cold storage solutions using MPC technology, enabling users to choose or combine these methods based on their security needs and convenience. Whether you prefer the ease of access of hot wallets or the enhanced security of cold storage, ZERT offers a flexible approach to managing your Bitcoin investments.

Bitcoin for Beginners Summarized

When looking at Bitcoin wallets, self-custody is the best option. Whether you opt for hot or cold storage will depend on your personal requirements. Bitcoin self-custody means there is no ownership dispute, the Bitcoin is yours, and you’re responsible for protecting it.

Don’t leave your crypto with an exchange. It’s not worth the risk.

Frequently Asked Questions (FAQs)

What happens if a Bitcoin wallet provider goes out of business?

If a Bitcoin wallet provider goes out of business, your Bitcoin remains safe as long as you have your private keys or seed phrase. You can use these to access your Bitcoin with another wallet provider.

How can I recover my Bitcoin wallet if my device is lost or stolen?

You can recover your Bitcoin wallet on a new device using your seed phrase. It's crucial to keep this phrase secure and accessible only to you.

Are there any costs associated with transferring Bitcoin to a self-custody wallet?

Yes, transferring Bitcoin typically involves a network fee, which varies based on the blockchain's congestion at the time of the transaction. This fee is not specific to self-custody wallets but applies to all Bitcoin transactions.

Can someone else access my Bitcoin if they know my wallet address?

No, knowing your wallet address only allows others to send Bitcoin to you. They cannot access or steal your Bitcoin without your private keys.

Can I convert my Bitcoin to other cryptocurrencies within a self-custody wallet?

Some self-custody wallets have built-in exchange features or can connect to decentralized exchanges (DEXs) allowing you to swap Bitcoin for other cryptocurrencies.

How do I verify a Bitcoin transaction has been completed?

You can verify a transaction by checking your wallet or using a blockchain explorer. You'll need the transaction ID, which is provided when you make or receive a payment.

What's the difference between a Bitcoin wallet and a Bitcoin exchange?

A Bitcoin wallet stores your private keys, allowing you to access and manage your Bitcoin. A Bitcoin exchange is a platform where you can buy, sell, and trade Bitcoin and other cryptocurrencies, often providing a custodial wallet.

Do I need an internet connection to receive Bitcoin in my cold wallet?

No, you don't need an internet connection to receive Bitcoin. However, to view the transaction or move your Bitcoin, you'll need to connect your cold wallet to a device with internet access.

What measures can I take to enhance the security of my Bitcoin wallet further?

Knowing how to ensure a secure crypto wallet is crucial. Use a hardware wallet for cold storage, enable two-factor authentication (2FA) for online wallets, regularly update your wallet software, and never share your private keys or seed phrase.

How do updates to the Bitcoin network affect my wallet?

Updates to the Bitcoin network, or hard forks, can affect wallets. It's important to follow guidance from your wallet provider on updates to ensure compatibility and security.

What should I look for in a self-custody wallet to ensure it's user-friendly for beginners?

Look for a wallet with a straightforward interface, clear instructions for setup and use, strong customer support, and educational resources to help you understand security practices.