DEX is short for decentralized exchange. They are peer-to-peer marketplaces where cryptocurrency investors can complete transactions with one another without a centralized middleman.

Definition

Decentralized crypto exchanges provide one of the most important elements of defi – the ability to buy, sell, and swap cryptocurrencies without a financial institution, broker, bank, or large corporate exchange.

So, what is a DEX, how do they work, and why are they important?

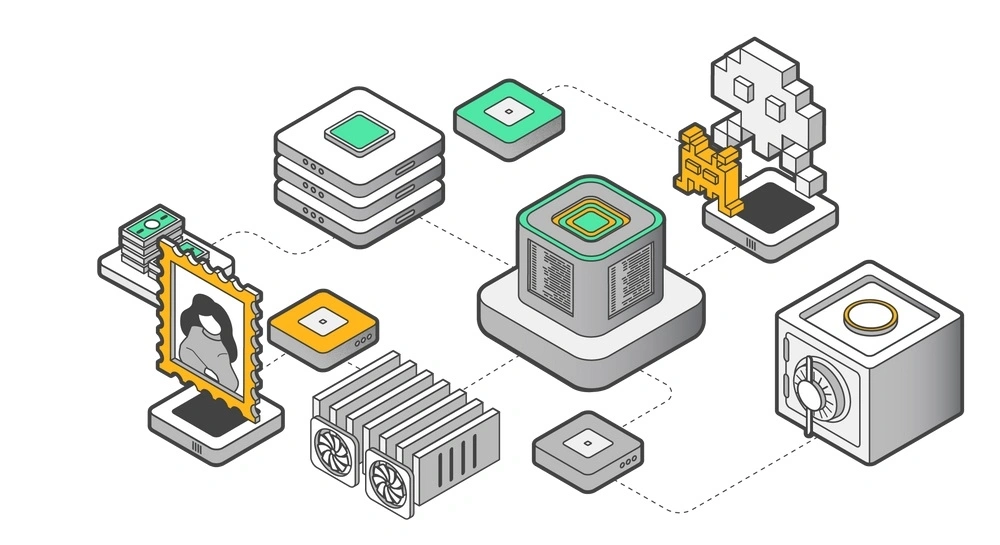

How Do DEXs Work?

The main difference between crypto-decentralized exchanges and traditional exchanges such as Coinbase is the fact they don’t work with fiat currency. By design, they are used for cryptocurrency-only transactions, meaning no fiat money can pass through the network.

With a centralized exchange, you can use your dollars to buy cryptocurrency. Then, you can sell your cryptocurrency and receive dollars in return. However, all of these transactions are processed by the exchange, they go through the platform's order book rather than the decentralized blockchain network used by DEXs.

On the other hand, decentralized crypto exchanges use the open-source blockchain to settle transactions. By harnessing the power of smart contracts, DEXs are able to ensure a smooth and transparent transaction process that protects buyers, sellers, and swappers.

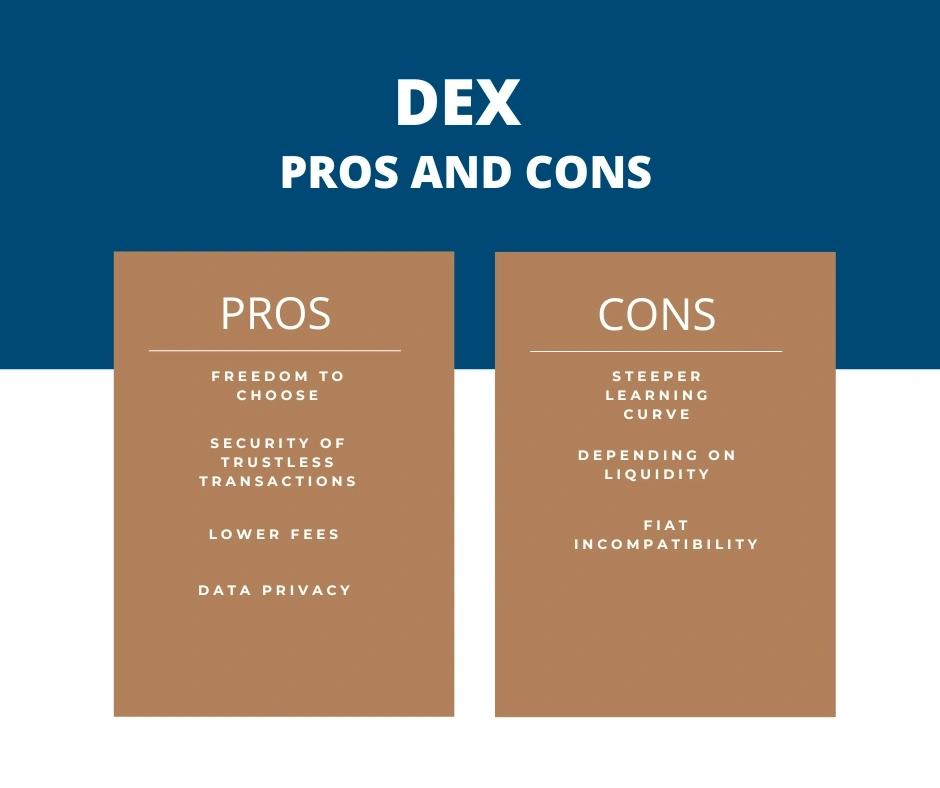

The Benefits of A Decentralized Crypto Exchange

Freedom To Choose

There are thousands of cryptocurrencies currently available to trade. However, centralized exchanges have the power to choose which they are going to list on their platform. By doing so, they’re retaining power, and deciding what you can and cannot trade. Often, they only choose established coins with high trading volumes that have developed a reputation for security.

On the flip side, a decentralized exchange provides the platform for up-and-coming, less established coins to be traded. The advantages of P2P DEXs open up the ability to buy and sell many altcoins you may not otherwise get access to.

Security of Trustless Transactions

As mentioned, a decentralized exchange uses smart contracts to process transactions rather than the order book of a CEX. All trades are recorded on the blockchain for all to see. What’s great about this is the drastically reduced risk of hacking. CEXs are obvious targets for hacking as they store funds, process thousands of transactions, and hold crypto wallet information.

A DEX doesn’t hold any funds at all, meaning the chance of a hack drastically reduces.

Lower Fees

Transaction fees and gas fees are one of the most talked about topics in crypto. As there is no intermediary taking a cut for their services, DEXs use the exact same gas fees as the network it’s built on. It’s important to remember these fees fluctuate based on network activity and demand.

Data Privacy

When signing up for a CEX, you have to provide some basic personal information. Also, if you haven’t set up your own external crypto wallet, the exchange keeps hold of the private keys. This means you don’t actually own the wallet.

To use a DEX, you need your own digital wallet, meaning your private keys are not stored in the exchanges database. This allows you, as the wallet owner, to establish your own security measure, giving you complete control over your cryptocurrency.

Enhanced Privacy and Anonymity

Decentralized exchanges take data privacy to a new level by offering enhanced privacy and anonymity to their users. Unlike centralized exchanges that require personal information for account creation and often comply with KYC (Know Your Customer) regulations, DEXs allow users to trade directly from their wallets. This setup minimizes the risk of personal data breaches and enables traders to maintain their anonymity.

Direct Control Over Assets

DEX users have direct control over their assets, eliminating the need for a third party to hold funds. This direct custody minimizes the risk of theft or loss due to exchange hacks, a common concern with centralized platforms. By trading directly from their wallets, users ensure that they retain ownership of their private keys, thereby maintaining ultimate control over their assets.

Increased Resilience to Censorship

The decentralized nature of DEXs makes them inherently resistant to censorship and regulatory interference. Since there is no central point of control, it's challenging for authorities to shut down or restrict access to these platforms. This resilience supports a free and open market, where users globally can trade without fear of censorship based on their location or government policies.

Transparent and Immutable Transaction Records

All transactions on a decentralized exchange are recorded on the blockchain, providing a transparent and immutable history of trades. This transparency ensures fairness and trust among users, as all actions are verifiable and cannot be altered. It also aids in the auditability of trades, enhancing the overall integrity of the trading environment.

Accessibility and Inclusivity

DEXs offer a more inclusive platform for trading, as they are accessible to anyone with an internet connection and a digital wallet. This openness democratizes access to financial markets, especially for people in regions with limited access to traditional banking or financial services. By lowering the barriers to entry, DEXs contribute to the broader adoption and spread of cryptocurrencies and decentralized finance (DeFi) solutions.

Innovation and Flexibility

The open-source nature of many decentralized exchanges creates a hotbed of innovation within the crypto space. Developers can propose, test, and implement new features, trading pairs, and financial instruments at a pace unmatched by traditional exchanges. This flexibility accelerates the evolution of financial services and allows DEXs to quickly adapt to the market's needs and users' demands.

Ecosystem Synergies

Decentralized exchanges play a crucial role in the broader DeFi ecosystem by facilitating seamless interactions with other decentralized applications (DApps). Users can easily move assets between different platforms to participate in staking, lending, borrowing, and yield farming, among other activities. This interoperability creates a synergistic environment that enhances the user experience and amplifies the benefits of decentralized finance.

The Disadvantage of A Decentralized Crypto Exchange

Usability

While CEXs are the most popular way of trading crypto, DEXs are very much in their infancy. Currently, the platforms aren’t as user-friendly as their centralized counterparts. If you’re new to crypto and blockchain technology, they can be daunting and difficult to use.

Firstly, users must choose an external digital wallet and fund this with cryptocurrencies. Then, they need to link their new digital wallet with the DEX. Until they’ve done this, they can’t use the decentralized crypto exchange.

Compared with signing up for and using a centralized exchange, this is a long-winded process and a sharp learning curve for newbies.

Liquidity

P2P transfers rely on market liquidity. As there is no centralized exchange, there needs to be individual buyers and sellers active in the market at all times. That being said, crypto decentralized exchanges are growing in popularity and are becoming more widely accepted. As crypto adoption increases and more people become familiar with blockchain technology, investors will continue to switch from CEX to DEX.

Fiat Compatibility

To facilitate the mass adoption of decentralized exchanges, they need to address the problem of not accepting transactions that facilitate buying crypto with fiat currency. As it stands, users would have to work with another platform to buy crypto with dollars, and if they want to exit the crypto space and convert back to dollars.

This functionality would open DEXs to a mass audience, helping new investors start there rather than having to opt for the usability of CEX.

Key Concepts Related to DEXs

Liquidity Pools

Liquidity pools are collections of funds locked in a smart contract used to facilitate trading by providing liquidity on decentralized exchanges. Users, known as liquidity providers (LPs), add an equal value of two tokens to a pool to create a market. In return, LPs earn trading fees from the trades that happen in their pool, proportional to their share of the pool's total liquidity

Order Books

Order books are a traditional method used in trading platforms to match buyers' and sellers' orders. An order book lists the number of units being bid (buy orders) or asked (sell orders) at each price point. Decentralized exchanges leveraging order books operate similarly to their centralized counterparts but are less common due to the blockchain's transparency and latency challenges.

Automated Market Makers (AMMs)

AMMs are the backbone of many popular DEXs, replacing traditional order books with algorithms to price assets. Rather than matching buy and sell orders, prices are determined by a mathematical formula based on the assets' current ratio in a liquidity pool. This allows for continuous and automated trading without the need for matching orders, facilitating a more efficient and decentralized trading environment.

Yield Farming

Yield farming involves users staking or lending their crypto assets in return for rewards. In the context of DEXs, it often refers to providing liquidity to earn fees from trades plus additional rewards, often in the form of the platform's native token. Yield farming can offer higher returns than traditional investments, but it comes with higher risks, including impermanent loss.

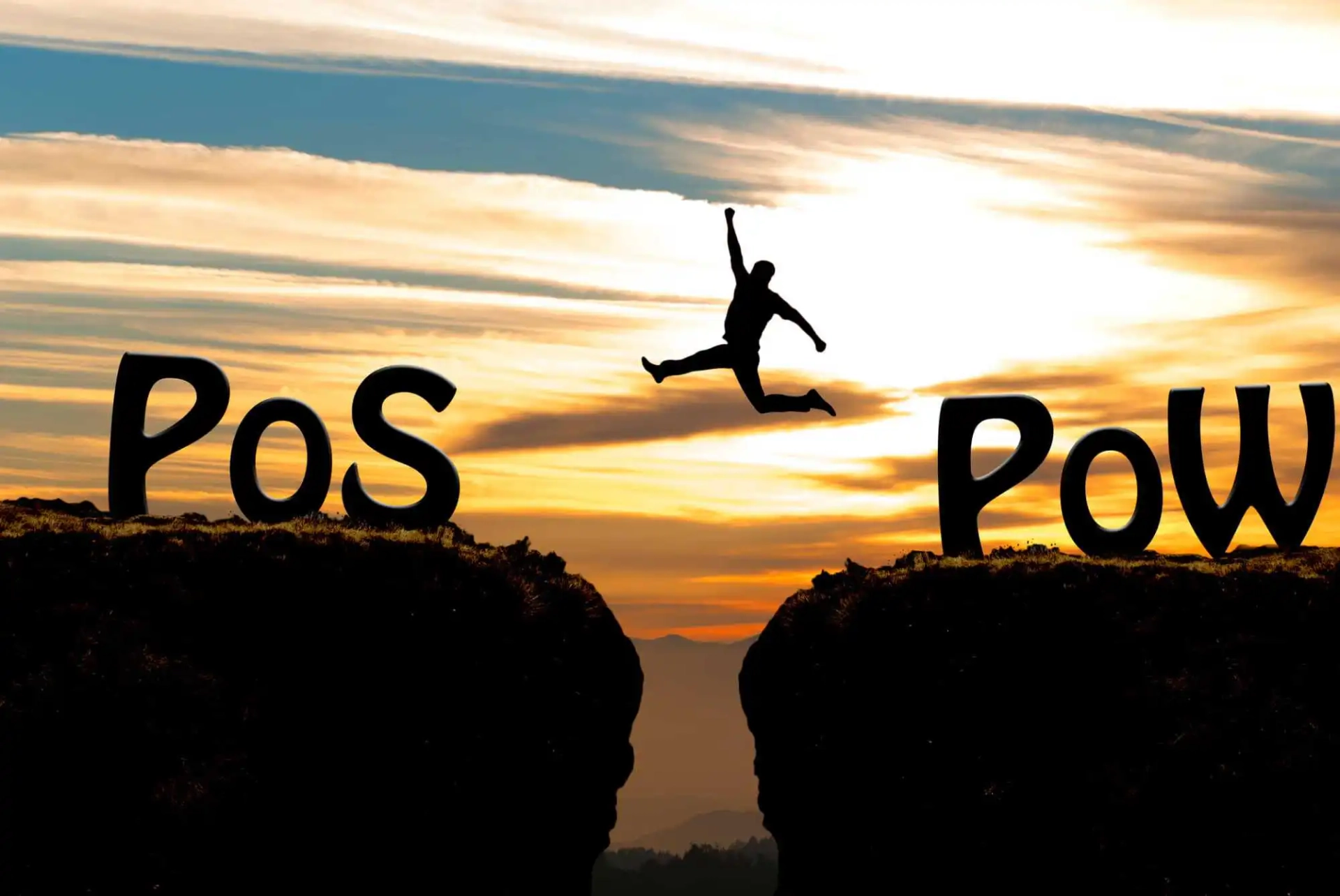

Cross-Chain Swaps

Cross-chain swaps enable the exchange of tokens between different blockchains without the need for a centralized intermediary. This is increasingly important as the cryptocurrency ecosystem becomes more fragmented across various blockchains. Solutions include wrapped tokens, bridge services, and protocols designed to facilitate secure and trustless trades across chains.

These concepts are fundamental to understanding how decentralized exchanges operate and the broader DeFi ecosystem. They highlight the innovative approaches being taken to solve traditional financial problems in a decentralized and permissionless way.

Examples of Popular DEXs

Uniswap

Blockchain: Ethereum

Uniswap is one of the first and most popular DEXs on the Ethereum blockchain. It uses an automated market maker (AMM) model to provide liquidity and enable trading without the need for traditional order books. Users can swap a wide range of ERC-20 tokens, provide liquidity to earn fees, and participate in governance through the UNI token.

SushiSwap

Blockchain: Initially Ethereum, now Multi-Chain

SushiSwap started as a fork of Uniswap but has since expanded its offerings to include a multi-chain ecosystem supporting various blockchains. It offers similar AMM functionalities, yield farming, and staking opportunities. SushiSwap is known for its SUSHI token, which grants governance rights and a share of the platform's trading fees.

PancakeSwap

Blockchain: Binance Smart Chain (BSC)

PancakeSwap is the leading DEX on the Binance Smart Chain, known for its low transaction fees and fast transaction speeds. It offers a range of features including AMM services, yield farming, lottery, and NFTs. CAKE, its native token, is used for governance and staking.

Curve Finance

Blockchain: Ethereum, with deployments on other chains

Curve specializes in the efficient trading of stablecoins and wrapped tokens (like Bitcoin on Ethereum), offering low slippage and reduced impermanent loss. It's designed for high liquidity and minimal price impact, making it a go-to for stablecoin swaps. CRV token holders can vote on governance decisions.

Balancer

Blockchain: Ethereum

Balancer is both a DEX and an automated portfolio manager. Users can create custom liquidity pools with up to eight assets in any ratio, not just the traditional 50/50 found in many AMMs. This flexibility allows for self-balancing diversified portfolios. BAL tokens are awarded to liquidity providers and grant governance rights.

In Summary - What is a DEX?

So, what is a decentralized crypto exchange? They are platforms that enable P2P crypto transactions to take place. The key benefits of a DEX enable investors to stay true to the core principles of cryptocurrency and decentralized finance. Furthermore, they provide a level of security that can’t be matched by centralized exchanges.

Check out Zert’s range of institutional-grade crypto wallets that empower you to start trading on decentralized exchanges while keeping your portfolio more secure than ever.